INSTRUCTIONS FOR FILLING FORM 49A (a) Form to be filled legibly in BLOCK LETTERS and preferably in BLACK INK. Form should be filled in English only (b) Each box, wherever provided, should contain only one character (alphabet /number / punctuation sign) leaving a blank box after each word. Form 49A is the PAN Card Form used by Indian citizens, Indian companies, entities incorporated in India or unincorporated entities formed in India. It is governed under Rule 114 of the Income Tax Rules, 1962 which relates to the application for allotment of a Permanent Account Number (PAN). 49A Application for Allotment of Permanent Account Number In the case of Indian Citizens/lndian Companies/Entities incorporated in India/ Unincorporated entities formed in India See Rule 114 To avoid mistake (s), please follow the accompanying instructions and examples before filling up the form Assessing officer (AO code).

Download Form 49A New Form for PAN (Permanent Account Number) Application under Income Tax Act .

- Reprint of PAN card: This application should be used when PAN has already been allotted to the applicant but applicant requires a PAN card. A new PAN card bearing the same PAN is issued to applicant. While filling this form, applicant should not select any of the check boxes on the left margin of the form. However, the check box for Item no.

- Form 49AA: PAN Application form (With Transgender & Single mother Clauses) with instructions For Individuals not being a Citizen of India / Entities incorporated outside India: PAN-CR: Request For New PAN Card or / and Changes or Correction in PAN Data (Revised with Transgender Clause) with instructions Form 49B.

Why Form No 49A is used

Form 49A if Application for Allotment of Permanent Account Number [In the case of Indian Citizens/lndian Companies/Entities incorporated in India/ Unincorporated entities formed in India] See Rule 114 of Income tax Rules . To avoid mistake (s), please follow the accompanying instructions and examples before filling up the form

Who can apply for PAN in Form 49A?

All existing assessees or taxpayers or persons who are required to file a return of income, even on behalf of others, must have a PAN. Any person, who intends to enter into economic or financial transactions where quoting PAN is mandatory, must also have a PAN.

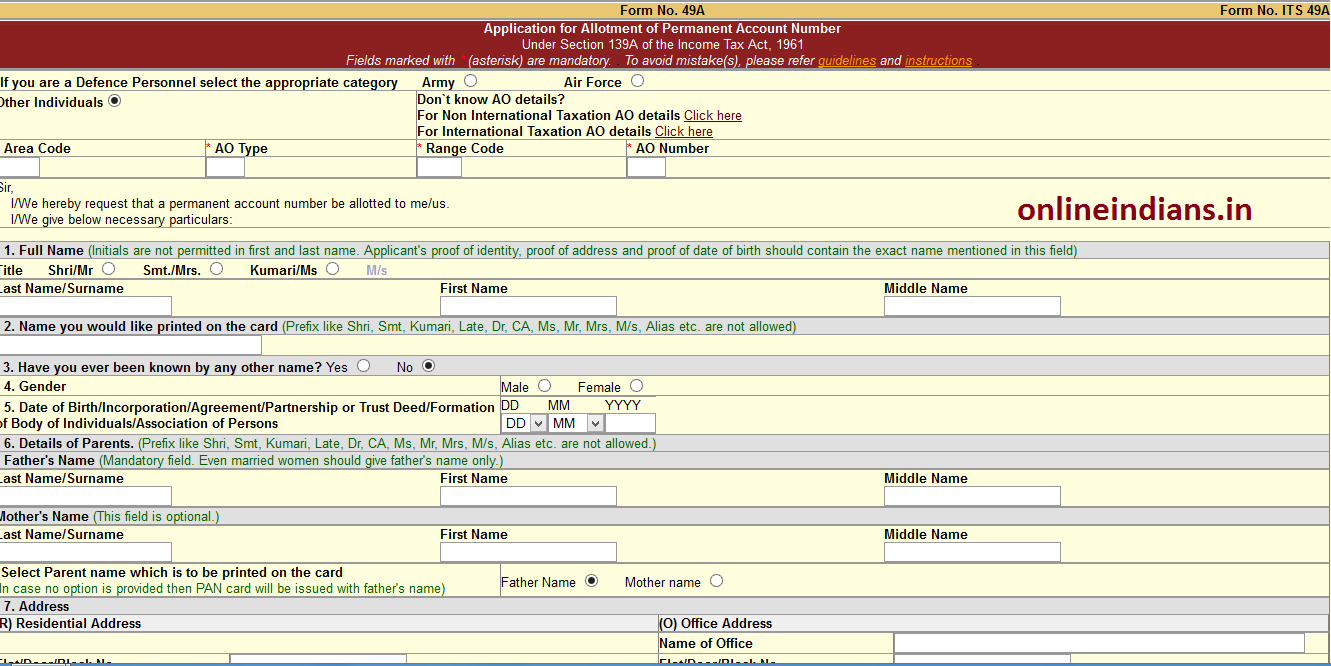

Format of Form 49A PAN form

Download Form 49A Click here

How to fill Form 49A PAN form

- Form to be filled legibly in

- Each box, wherever provided, should contain only one character (alphabet /number / punctuation sign) leaving a blank box after each word

- ‘Individual’ applicants should affix two recent colour photographs with white background (size 3.5 cm x 2.5 cm) in the space provided on the form. The photographs should not be stapled or clipped to the form. The clarity of image on PAN card will depend on the quality and clarity of photograph affixed on the form

- Signature / Left hand thumb impression should be provided across the photo affixed on the left side of the form in such a manner that portion of signature/impression is on photo as well as on form.

- Signature /Left hand thumb impression should be within the box provided on the right side of the form. The signature should not be on the photograph affixed on right side of the form. If there is any mark on this photograph such that it hinders the clear visibility of the face of the applicant, the application will not be accepted.

- (g) AO code (Area Code, AO Type, Range Code and AO Number) of the Jurisdictional Assessing Officer must be filled up by the applicant. These details can be obtained from the Income Tax Office or PAN Centre or websites of PAN Service Providers on www.utiitsl.com or www.tin-nsdl.com

- Guidelines for filling the Form 49A are enclosed in Form 49A Click here

- Guidelines for Form 49A for Non Residents : Click here

Fees for Form 49A (PAN form)

The fee for processing PAN application is Rs 110/- (including goods & service tax). In case, the PAN card is to be dispatched outside India then additional dispatch charge of Rs 910/- will have to be paid by applicant.

Mode of Payment

Payment may be made online using Credit / Debit card and Net-banking facility

Alternatively, the payment may be made by Demand draft drawn in favour of ‘NSDL-PAN’

payable at Mumbai.

Take acknowledgement after Submitting Form 49A PAN Form

Applicant will receive an acknowledgment containing a unique number on acceptance of this form. This acknowledgement number can be used for tracking the status of the application.

Instructions for Form 49A (PAN form)

Those already allotted a ten digit alphanumeric PAN shall not apply again as having or using more than one PAN is illegal.

However, request for a new PAN card with the same PAN or/and Changes or Correction in PAN data can be made by filling up ‘Request for New PAN Card or/and Changes or Correction in PAN Data’ form available from any source mentioned in (a) above.

The cost of application and processing fee is same as in the case of Form 49A.

Apply Form No 49A (PAN Form ) Online

Paperless online PAN application facility based on eSign (i.e. Aadhaar based e-Signature)

and Digital Signature Certificate (DSC) has been provided to applicant enabling PAN

applicants to furnish their application for PAN online, upload scanned images of supporting

documents, photo & signature and digitally sign the application online.

No physical documents are required to be sent by the PAN applicants for eSign and

DSC based PAN applications.

How to Apply PAN Card (Permanent Account Number )

On successful submission of online application and payment (for online mode of payment), an acknowledgement receipt is generated.

Save and take a print out of the acknowledgement receipt.

The duly signed and photos affixed acknowledgement receipt alongwith prescribed

supporting documents should be sent to ‘INCOME TAX PAN SERVICES UNIT (Managed

by NSDL e-Governance Infrastructure Limited)’ at 5th Floor Mantri Sterling , Plot No.

341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune-411 016.

The 15 digit acknowledgement no. appearing on the acknowledgement receipt can be used for tracking status of application.

Documents to be enclosed with PAN Form 49A

Documents for the following are required to be enclosed with Form 49A /PAN Form

Proof of Identity

Proof of Address

Proof of date of birth

Supporting documents

Proof of Identity (POI), Proof of Address (POA) and Proof of Date of Birth (PODB) as per

Rule 114(4) of Income Tax Rules, 1962

Proof of AADHAAR (Copy of AADHAAR Card), if AADHAAR is mentioned.

Additional documents for PAN Change Request application

Proof of PAN – Copy of PAN card/allotment letter

Proof of Change Requested – Documents indicating change of name (i.e. Name/Father’s name) from old name to new name

- Indian Citizen

- Foreign Citizen/NRI

Documents to be enclosed for 49A are enclosed in annexure to Form 49A Click here

Important Check Points while filling form 49A

No initials/abbreviations to be used in name/father’s name (except for Middle name).

No prefixes such as Dr, Col, Major, etc. should be mentioned in ‘Name’, father’s name and

‘Name to be printed on card’ fields.

Representative Assessee (RA) details mandatory for minor/lunatic/idiot/deceased cases.

POI, POA and PODB should indicate exactly the same name as mentioned in the application.

AO Code in PAN Form 49A

It is mandatory for the applicants to mention the AO code in the PAN application. The AO code under jurisdiction of which the applicant falls, should be selected by the applicant. The applicants are advised to be careful in selection of the AO code. The details given here are as per the information received from the Income Tax Department. Ms project 2010 free download with crack. For additional information applicants may contact local office of Income Tax Department or call Aaykar Sampark Kendra on 0124-2438000.

Track your PAN Application Status

Use 15-digit acknowledgement number for tracking the status of application, as under:

Check status at TIN website . You can track status of your PAN Click here

SMS ‘NSDLPAN 15 digit ack. no.’ to 57575.

E-mail us at tininfo@nsdl.co.in

Contact our Call Centre at (020) – 2721-8080

Fax us your queries at (020) – 2721-8081

Write to us at following address:

INCOME TAX PAN SERVICES UNIT (Managed by NSDL e-Governance Infrastructure

Limited), 5th Floor Mantri Sterling , Plot No. 341, Survey No. 997/8, Model Colony, Near

Deep Bungalow Chowk, Pune-411 016

FAQs on Form 49A PAN Form

Who can apply on behalf of minor, lunatic, idiot, mentally retarded, deceased and wards of court?

Section 160 of IT Act, 1961 provides that a minor, lunatic, idiot, mentally retarded, deceased, wards of court and such other persons may be represented through a Representative Assessee.

In such cases,

Is it compulsory to quote PAN on ‘return of income’?

Yes, it is compulsory to quote PAN on return of income.Do I need to apply for a new PAN when I move from one city to another?

Permanent Account Number (PAN), as the name suggests, is a permanent number and does not change.

Changing the address though, may change the Assessing Officer. Such changes must, therefore, be intimated to ITD so that the PAN database of ITD can be updated. One can intimate change in address by filling up the form for Request for New PAN Card or/and Changes or Correction in PAN data. This form can be submitted at any TIN-FC or online at NSDL-TIN website.

Can I have more than one PAN?

No. Obtaining/possessing more than one PAN is against the law and may attract a penalty up to

What should I do if I have more than one PAN?

If you have more than one PAN, you should surrender the additional PAN(s) by logging into ITD website at http://incometax.sparshindia.com/pan/newPAN.asp. Alternatively, you may fill and submit PAN Change Request application form by mentioning the PAN which you wish to retain on the top of the form. All other PAN/s inadvertently allotted to you should be mentioned at item no. 11 of the form and the corresponding PAN card copy/ies should be submitted for cancellation along with the form.

Helpline for Form 49A / PAN Form

For more information on Form 49A / Application status enquiry contact:

Call Center 1800-180-1961

NSDL e-Gov Call center No 020-27218080

Email : tininfo@nsdl.co.in

SMS: NSDLPAN Acknowledgement No. & send to 57575 to obtain application status. For example u Type ‘NSDLPAN 881010101010100’ and send to 57575

Address : INCOME TAX PAN SERVICES UNIT (Managed by NSDL e-Governance

Infrastructure Limited), 5th Floor, Mantri Sterling, Plot No. 341, Survey

No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune – 411 016.

Other Study Material for Form 49A

PAN Card Application form 49A Amended to have Transgender option : CBDT Notification

Aadhaar mandatory for Applying PAN ; Form 49A revised w.e.f 01.07.2017

PAN application through Incorporating Company Electronically (SPICe) (Form No. INC-32)

PAN card Application Form Documents required

PAN card requirement eased for corporate assessees

PAN Card for NRI’S

Permanent Account Number (PAN) : Free Study Material

How to open cdx file. For info Visit Income tax website of India

Form 49A, pan card apply , pan card download , pan card details ,

pan card correction form , pan application status , pan card status by name and date of birth ,

new pan card , pan card online print, duplicate pan card online ,download pan card soft copy ,

area code for pan ,pan card correction form download , uti pan application status ,

pan card acknowledgement slip download , form 49a , how to fill pan card form online ,

PAN form 49 A is designed for the use of Indian citizens, entities incorporated in India, unincorporated entities formed in India and Indian companies. PAN application form 49 A governed under rule 114 of the Income Tax rules, 1962. Form is available both offline and online. You can download the PAN form from the NSDL website.

Structure of Form 49 A

- Filling of personal details like address, name, contact details along with signature,and photograph on the submitted documents.

- The first two pages of the form need to be filled by the applicant and in the remaining pages, instructions mentioned for filling Form 49 A.

Detailed list of Form 49 A Fields

Assessing Officer (AO Code)

It consists of the Area Code, Range code, AO number ,and AO type. It is to be filled by the applicant and for this, information can be generated online on NSDL Website’s AO Code search for PAN.

Full Name

Make selection of the title from Mr. and Mrs. and in the blocks provided, write your full name.

Name Abbreviations

Here you need to mention an abbreviation of your name which will print on your PAN card. Always make use of the name that is present on your other documents as well.

Do you have any other name?

In case you have two names, you should mention that second name also in this section.

Gender

New Pan Card Application Form 49a Word Format Download

Mention your gender in this section

Date of Birth/Incorporation/Agreement/Partnership or Trust Deed/ Formation of Body of individuals or Association of Persons

Parents Detail

It is to be filled only by individual applicants.

Address

You need to mention in this section, your office address and residential address. In the next section, mark the address (office or residence) that you want to keep as your address for communication. On this same address, your PAN card will be dispatched.

Contact details and E-mail ID

Strong>

Status of the Applicant

The applicant can fall in any one of the following categories-

- Individual

- Hindu Undivided Family

- Company

- Partnership Firm

- Government

- Association of Persons

- Trusts

- Body of Individuals

- Local Authority

- Artificial Juridical Persons

- Limited Liability Partnership

Registration Number

It is to be filled in the PAN form only by LLPs, Companies etc.

Aadhaar Number

Source of Income

You can make a selection from the following as per your convenience:

- Salary

- Capital Gains

- Income from Business /Profession

- Income from Other sources

- Income from House property

- No income

Representative Assessee (RA)

If you are making your income tax filed by another person, then it is must to mentioned her/his address and name in the PAN card form.

Submission of Documents

- Identity Proof

- Address Proof

- Date of Birth Proof

New Pan Card Application Form 49a Word Formation

Declaration

New Pan Card Application Form 49a Word Format

In the end, the applicant needs to fill his name along with the date and place of application and sign the form.

Ibackup unlocker crack. Procedure to fill form 49 A via offline mode.

Some necessary steps to follow in order to file an application for a PAN card through offline methods:

- You need to download the FORM 49 A from the official website of the Income Tax Department of India or can also make a visit to any Income Tax Pan service Centre which is managed by UTI Infrastructure and Services Limited (UTIISL).

- After downloading the form or collecting the form, fill-up the form with all sections in the 08 pages.

- After filling up the PAN application form, you will have to send a demand draft of Rs.107 including tax along with the application form. An additional amount of Rs.887 is to be charged if the PAN application form needs to be sent outside India.

- Make sure that form must be sent along with a copy of your address proof and identity proof. INCOME TAX PAN SERVICES UNIT (Managed by NSDL e-Governance, Infrastructure Limited), 5th Floor, Mantri Sterling, Plot No. 341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune - 411 016.

New Pan Card Application Form 49a Word Formatted

Procedure to fill form 49 A via online mode

- To apply for PAN Card online, visit the website of NSDL where you can fill all the required information.

- Click on the 'Apply Now' Tab to fill the online Application form for New PAN card.

- Fill your PAN application form online and click on Submit Button.

- Verify your details and click on Proceed to Payment Button.

- Make a payment. This is a one-time fee.

- After making a successful Payment, download and print your pre-filled application form (along with the Instruction sheet).

- Paste photo, sign, attach documents and post to our address (You will get the postal address on the instruction sheet)

Note

In case you lost your PAN Card, then with the help of PAN number, apply for duplicate PAN card.

New Pan Card Application Form 49a Word Format 2018

In case you want to make any changes in your PAN card then apply for changes in PAN card (like Name, Father's Name, Date of birth ,etc).

Comments are closed.